Litecoin is one of the most exciting projects out there. Founded and championed by ex-Google employee Charlie Lee, Litecoin serves as the silver to Bitcoin’s gold. However, that statement just doesn’t do Litecoin enough justice. Time and again, Litecoin has proven itself to be a trailblazer in the crypto space. Litecoin is one of the forked protocol ofBitcoin’s original code. So, should you invest in Litecoin? How would you go about it if you wanted to buy Litecoin? Let’s explore that in this article.

How to Buy Litecoin: Ultimate Investor’s Guide

Litecoin and Altcoins: Why You Shouldn’t Invest Just in Bitcoin

One of the broadest generalizations ofcryptocurrencies is “Bitcoin and Altcoins.” In other words, Bitcoin and coins that are not Bitcoin. So, if Bitcoin is the leader of the crypto-economy, why would you want to invest in any other coins? Well, it turns out that there are a lot of reasons:

Bitcoin is Expensive

How does a cryptocurrency get its value? Well, there are two parts to it. A crypto’s value is made up of its:

- Intrinsic value: The value that the token gains from the credibility and utility of its project.

- Speculative value: The value that the token gains from speculative traders who expect its price to fluctuate in the near future.

Speculative investors are a valuable part of any ecosystem. However, it is hazardous for a token to be priced purely on its speculative value. For real sustenance, a token needs to be heavily dependant on its intrinsic value. So, how does a token gets its intrinsic value? The intrinsic value is created by the underlying project and how much percentage of this value is captured by the token.

As of right now, a majority of Bitcoin’s price is based on pure speculation and hence can be overvalued. In the near future, when Bitcoin gets more utility, their price will be made more of intrinsic value. However, for now, Bitcoin’s price tends to get inflated based on pure speculation. As such, it is difficult for investors who are not that well-to-do to make a meaningful investment in Bitcoin.

Bitcoin is Full of FOMO Investors

Fair or not, being the most popular cryptocurrency, Bitcoin gets a lot of attention. As such, a lot of naive and newbie investors enter the space who have no better reason to invest other than “I don’t want to be left out.” The problem with this is that they don’t have any real knowledge of the blockchain. They are not buying Bitcoin because they are interested in the blockchain technology and its potential, they are doing so because someone told them to invest in it. The moment someone famous criticizes Bitcoin or cryptocurrencies, these investors will sell all their assets, crashing the market in the process. Now, we are not saying that Litecoin is free form this phenomenon, however, the fact is that since it is less popular than Bitcoin, it has comparatively less number of FOMO investors.

Altcoins are Cheap(er)

Altcoins trade for very low prices when compared to Bitcoin. This is great for two reasons:

- It is much more affordable than Bitcoin, meaning an average investor can still make a pretty substantial investment with the altcoin. Eg. $10,000 won’t buy you 2 BTC but it will buy you 125 LTC(litecoin).

- Because these coins are so cheap, they have tremendous upside potential. The price of litecoin increased by 7,291% from the beginning of 2017 to November 2017! In comparison, bitcoin “only” increased by 1731%.

If the altcoin of choice has good quality and potential, then there is every chance that the price will appreciate significantly soon.

Altcoins are More than Just Coins

While Litecoin, quite like Bitcoin, is a payment mechanism, there are tons of coins out there which provide a lot more utility than being a pure payment coin. Most of the altcoins are based on some pretty revolutionary ideas which could change the world. Ethereum, NEO, andEOS are smart contract platforms which can be used to developers around the world to build their applications. Golem allows people to lend their computing power to anyone connected to the Golem network. Because of these different utilities, these altcoins have much higher upside potential.

Altcoins Can be Mined Easily

Bitcoin uses the proof-of-work consensus mechanism. Proof-of-work is pretty straightforward to understand.

The miners use their computational power to solve tough cryptographic puzzles. The puzzle solving needs to be extremely hard. If it is simple, then miners will keep mining blocks and drain out the entire bitcoin supply.

However, while the puzzle solving part is difficult, checking to see if the solution of the puzzle is correct or not should be simple.

And that, in a nutshell, is proof of work.

- Solving the puzzles and getting a solution should be tough.

- Checking to see if the solution is correct or not should be difficult.

- Now, both bitcoin and litecoin go about this a little differently.

Bitcoin uses the SHA-256 hashing algorithm for its mining purposes. Before long, miners discovered that they could exponentially increase their mining power by joining together and forming mining pools via parallel processing.

In parallel processing, program instructions are divided among multiple processors. By doing this, the running time of that program decreases significantly and that is basically what the mining pools are doing.

The SHA 256 puzzles require a lot of processing power, and that gave rise to specialized “application-specific integrated circuits aka ASICs. The only purpose that these ASICs served was bitcoin mining.

These mining pools would have an entire powerplant of ASICs explicitly designed for bitcoin mining.

Mining, as initially envisioned by Satoshi, was supposed to be a very democratic process. The idea was that any average Joe could sit on his laptop and contribute to the system by becoming a miner. However, with the rise of the ASIC plants, the average Joes have no chance to compete with the big companies.

However, altcoins mining is comparatively much more straightforward. Litecoin, e.g. uses the Scrypt mining algorithm.

Scrypt was initially named “s-crypt” however it is pronounced as “script”. While this algorithm does utilize the SHA 256 algorithm, its calculations are way more serialized than the SHA-256 in bitcoin. As such, parallelizing the calculations is not possible.

What does this mean?

Suppose we have two processes A and B.

In bitcoin, it will be possible for the ASICs to do A and B together at the same time by parallelizing them.

However, in Litecoin, you will need to do A and then B serially. If you try to parallelize them, the memory required becomes way too much too handle.

Scrypt is called a “memory hard problem” since the main limiting factor isn’t the raw processing power but the memory. This is precisely the reason why parallelization becomes an issue. Running five memory-hard processes in parallel requires five times as much memory. Now, of course, there can be devices manufactured with tons of memory in it, but two factors mitigate this effect:

- Ordinary people can compete by buying simple day-to-day memory cards instead of super-specialized ASICs.

- Pound-for-pound, memory is way more expensive to produce than SHA-256 hashing chips.

Real-world utility

Bitcoin has some significant obstacles to overcome before it becomes a proper means of payment. The chief obstacle, of course, is the scalability issue. Long story short, Bitcoin’s throughput and transaction times are pretty low for it to be used as payment in regular day-to-day transactions. Plus, some people prefer using Bitcoin as a store-of-value rather than a means of payment.

On the other hand, altcoins like Litecoin have a much higher transaction speed. Bitcoin can only manage 7 transactions per second while litecoin can do 56 transactions per second.

Portfolio Diversification

Finally, every investor should diversify their portfolio.

If you are entering the crypto game, then it goes without saying that you should start with Bitcoin. All said and done, Bitcoin remains the premier cryptocurrency. However, it is wrong to put all your eggs in one basket, as the adage goes. An educated and serious investor will always be looking to invest in as many coins as possible.

Technological Advances of Litecoin

Litecoin’s working process is similar to Bitcoin. Both of them leverage the blockchain technology to enable payment transfer between two entities without the need for a third-party. However, the reason why many people hold Litecoin in high regard is because of their willingness to experiment with potentially disruptive technologies. In our previous guide on Litecoin, we have already mentioned how Litecoin has worked on the following technologies:

- Lightning Protocol:Using hash timelock contracts (HTLCs) to create off-chain payment channels to exchange multiple micro-transactions without going through the blockchain. This is a scalability technique that many coins like Bitcoin, Litecoin, Decred, etc. are looking to use to increase their throughput.

- Atomic Swap: Atomic swap enables a cross-chain exchange of coins without the need of a third party. Eg. If Alice had 1 bitcoin and she wanted 100 litecoins in return, she would normally have to go to an exchange and pay certain fees to get it done. This technique also utilizes HTLCs.

- SegWit: Segregated Witness is the process by which the block size limit on a blockchain is increased by removing signature data from Bitcoin transactions. The signature data is kept in extended blocks which are attached to the main blockchain via side-chain.

Privacy and Fungibility

One property that Litecoin has recently looked into adding is “fungibility.” On January 28, 2019, Lee tweeted the following:

“Fungibility is the only property of sound money that is missing from Bitcoin & Litecoin. Now that the scaling debate is behind us, the next battleground will be on fungibility and privacy. I am now focused on making Litecoin more fungible by adding Confidential Transactions.”

So, what is fungibility? Investopedia defines it as follows:

“Fungibility is a good or asset’s interchangeability with other individual goods or assets of the same type.”

Suppose you borrowed $20 from a friend. If you return the money to him with ANOTHER $20 bill, then it is perfectly fine. You can even replace the money to them in the form of 1 $10 bill and 2 $5 bills. It is still fine. The dollar has fungible properties (not all the time though).

However, if you were to borrow someone’s car for the weekend and come back and give them some other car in return, then that person will probably punch on the face. If you went away with a red Impala and came back with another red Impala, then even that is not a done deal. Cars, in this example, are a nonfungible asset.

Cryptocurrencies use a transparent open ledger system to log their transactions. Everyone who is part of the blockchain’s network can observe the transactions in it and more importantly, everyone can see the trail of those transactions. So, suppose you own a bitcoin which once was used in some illegal transaction, eg. buying drugs, it would forever be imprinted in the transaction detail. What this in essence does is that it “taints” your bitcoin.

In certain bitcoin service providers and exchanges, these “tainted” coins will never be worth as much as “clean” coins. This kills fungibility and is one of the most often used criticisms against bitcoin. After all, why should you suffer if one of the previous owners of your bitcoin used it to make some illegal purchases?

Using privacy functions could mitigate this and give cryptocurrencies some much-needed fungibility. Litecoin is looking to integrate the MimbleWimble protocol to implement privacy. Lee tweeted:

“Litecoin dev team spent hours discussing how to add Confidential Transactions. The way to do a softfork CT is very similar to doing extension blocks and extension blk may be simpler and can do a lot more. We are now also exploring doing bulletproof MimbleWimble w/ extension blks.The extension blocks concept is similar to sidechains. Think of this as a MimbleWimble sidechain that is attached to the main chain using consensus via a softfork upgrade. You can opt-in by sending coins into the MW extension blocks and also send coins out back to the main chain.”

MimbleWimble is a privacy protocol which uses elliptic-curve cryptography and requires smaller keys than other cryptography types. It only needs 10% of the data storage requirements of the Bitcoin network. This makes Mimblewimble highly scalable and efficient. The problem with other privacy protocols is that they are incredibly bulky which compromises on its scalability.

Alright, so now that you know why you should invest in Litecoin, let’s move ontohow you can go about your investing/trading.

Fundamental Analysis vs Technical Analysis

Fundamental and technical analysis are the two foundations of trading. Before we go any further, you should at least know what those two terms mean.

Fundamental Analysis

This analysis looks at the big picture instead of price movements. When you are doing a fundamental analysis of a coin, you are looking at:

- The developer activity surrounding the coin. How many projects or positive developments is the project going through. Recently, Cardano’s value jumped by a significant amount after they released the mainnet version 1.5.

- The mainstream integration of the coin. Is some company or mainstream platform integrating the coin? If yes then that is going to significantly affect the price. Stellar XLM gained almost 50% in March 2019 after IBM announced the launch of World Wire, a model for cross border payments using the Stellar protocol.

- Significant world events can alter the price of the cryptocurrency as well as has been already discussed in this guide.

Keeping yourself up-to-date on all the current events is imperative for solid fundamental analysis.

Technical analysis

Technical analysis is a tool, or method, used to predict the probable future price movement of a currency pair, cryptocurrency pair, or a stock. It can be a creative and dynamic process which will help you gain a very deep perspective into the coin.

The core assumption behind Technical analysis is thus: Regardless of what’s currently happening in the world, price movements speak for themselves, and tell a story which helps you predict what will happen next.

So, how will you use these tools to actually buy Litecoin? Thankfully, since litecoin is one of the “big guns” in the crypto space, several exchanges will let you buy them in exchange for fiat money. If you are living in Canada, don’t look any further than Bitbuy.

Bitbuy – The Premier Candian Exchange

Bitbuy is a Canadian owned and operated digital currency platform. Founded in 2013, Bitbuy has consistently provided Canadians a dependable and trustworthy platform to buy and sell their cryptocurrencies. As already explained, Bitbuy was a fiat-to-crypto exchange where you can deposit Canadian dollars directly onto their website, to be exchanged for digital currency. Their headquarters are located in Toronto, Ontario and their services are available for Canadian traders across the country.

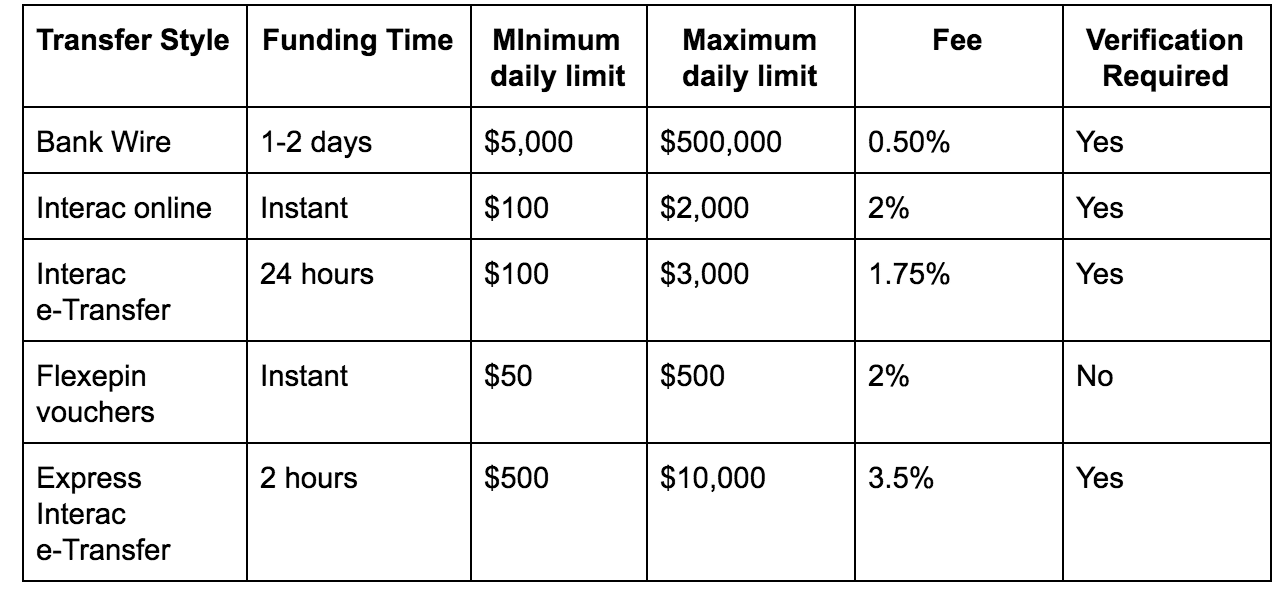

Bitbuy’s Purchases and Payment Methods

Bitbuy.ca accepts the following payment methods:

- Bank wire

- Interac online

- Interac e-Transfer

- Flexepin vouchers

- Express Interac e-Transfer

Another interesting feature of Bitbuy is that there are no fees for withdrawing your cryptocurrency. You can send your crypto to a private wallet, free of charge. This makes it ideal for long-term investors who want to hodl on to their cryptocurrency.

Your first-time purchases will be held for one to three business days for security reasons. If you have a verified account and have made more than three transactions on Bitbuy, your funds will be available in real time.

Ok, so How Do I Become a Verified Member?

The moment you become a verified member, you are entitled to use any payment method you want to fund your Bitbuy account. For verfiication, you will need to submit the required KYC details. The documents you must submit are:

- A color copy of your passport or driver’s license.

- A copy of a bank statement or utility bill showing your name and proof of address.

- A photo of yourself holding your government-issued ID.

- If the account is a business account, then additional documents proving “authority to act on behalf of a corporation” should be submitted.

The entire verification process usually takes between one to three business days.

Customer Support in Bitbuy

Bitbuy also has very prompt customer support. You can do the following to receive support on your query:

- Access the support section of the site and use the “Submit a request” button.

- Use the live chat support.

- Contact them via email or phone.

- If you live in Toronto then you can simply go to their office if needed.

How Safe is Bitbuy?

Bitbuy is a division of First Ledger Corp, which is a Toronto based blockchain and digital currency company. They have stated that the exchange complies with all Canadian laws. They have also taken the following precautions to keep your data safe:

- Bitbuy uses Secure Socket Layer (SSL) technology to protect users.

- They also utilize two-factor authentication for additional security.

- Bitbuy.ca operates with a 95% cold storage reserve for all digital currencies held on the site and executes daily encrypted and distributed backups to avoid any implications or attacks.

Pros and Cons of Bitbuy

Pros

- Buy cryptocurrencies directly with Canadian dollars.

- Searches for competitive rates across multiple exchanges.

- Express Interac e-Transfer allows for two-hour funding

- Users can choose from several payment options.

- Bank Wire payment method allows for high deposit limits.

- Pre-purchase transaction pricing calculator.

- Allows for quick CAD withdrawals.

Cons

- Only offers BTC, BCH, ETH, XRP, and LTC.

If you are a Canadian citizen, then you can go to Bitbuy right now and create your own account to start trading. Click here to create your account.

Conclusion

Hopefully, now you should have all the information necessary to go about your trading. Don’t just buy Litecoin just because we are telling you to do so. We request you to do thorough research and read up more about the project. You can start by reading our Litecoin guide here. To learn more about trading, read up our crypto trading guides here and here.

Copied from: https://blockgeeks.com/guides/buy-litecoin/

No comments:

Post a Comment