Altcoins

So, how we can avoid those mistakes in future trading? How to be mostly on the green side? First, it is essential to note that to trade right requires attention and your one hundred percent focus. Secondly, trading is not for everyone. The following tips are easy to internalize because these tips were “written in blood” (my blood). However, it’s still difficult to apply them in real-time. After all, humans are not rational.

Reason For Any Trade

Start a trading position only when you know why you’re starting it and have a clear strategy for afterward.

Not all traders are profitable since this is a zero-sum game (for everyone who benefits someone else loses on the other side). Large whales drive the Altcoins market: yes, the same ones responsible for placing huge blocks of hundreds of Bitcoins on the order book.

Not all traders are profitable since this is a zero-sum game (for everyone who benefits someone else loses on the other side). Large whales drive the Altcoins market: yes, the same ones responsible for placing huge blocks of hundreds of Bitcoins on the order book.

The whales are just waiting patiently for innocent little fish like us until we make trading mistakes. Even if you aspire to trade daily, sometimes it is better not to earn and do nothing, instead of jumping into the rushing water and exposing your coins to substantial losses. There are days where you only keep your profits by not trading at all.

Clear Stops, Clear Targets: Have a Plan

For each position, we must set a precise target level for taking profit and more importantly, a stop-loss level for cutting losses. A Stop-loss is setting the level of maximum loss we afford before the position gets closed.

Here again, it is important considering several factors when choosing a stop loss level correctly: Most traders fail when they fall in love with their position or with the coin itself.

They may say, “Here it will turn around, and I will get out of this trade with a minimum loss, I’m sure.” They’re letting their ego take control of them, and unlike the traditional stock exchange where extreme volatility is considered 2-3% daily, crypto trades are a lot riskier: it’s not unusual to find a coin dumping by 80% just in a few hours, and nobody wants to be the one who is left holding it.

FOMO: Be Aware

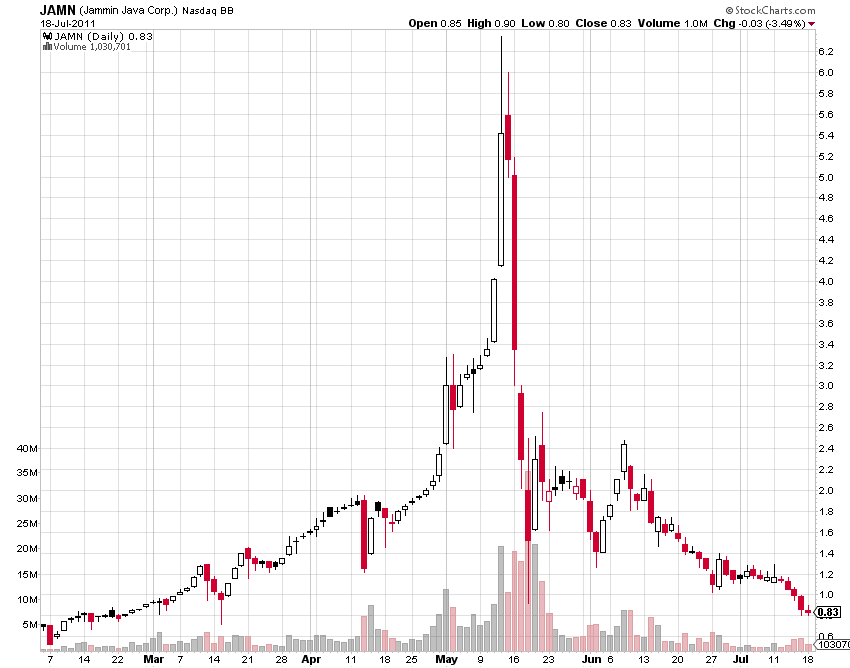

Meet the FOMO, or Fear of Missing Out: Indeed, it isn’t fun to see such situations from the outside – when a specific coin is being pumped up like crazy with huge two-digit gains in just minutes.

That bold green candle yells at you “you are the only one not holding me.” At exactly this point you will notice lame people flooding Reddit, Telegram trading groups and the exchanges’ Troll boxes to talk about this pump.

But what do we do now? Very simple: Keep moving forward. True, it’s possible that many may have caught the rise ahead of us and it can continue in one direction, but bare in mind that the whales (as mentioned above) are just waiting for small buyers on the way up to sell them the coins they bought for lower prices. Prices are now high, and it’s clear that the current lucky holders only consist of those little fish. Needless to say, the next step is usually the bright red candle which sells through the whole order book.

Risk Management – Not Only For Crypto

Pigs Get Fat; Hogs Get Slaughtered. This statement tells the story of the market profits from our perspective. To be a profitable trader, you never look for the edge of the movement. You look for the small gains that will accumulate into a big one.

Manage risk wisely across your portfolio. For example, you should never invest more than a small percentage of your portfolio in a non-liquid market (very high risk). To those positions we will assign greater tolerance – the stop and target levels will be chosen far from the buying level.

Cryptocurrencies Are Traded Against Bitcoin

The underlying asset creates volatile market conditions: Most Altcoins are traded at their most against Bitcoin, rather than FIAT.

Bitcoin is a volatile asset, compared to almost any FIAT, and this fact should be taken into consideration, especially in the days when the price of Bitcoin is moving sharply.

During past years, it was common that Bitcoin and Altcoins had an inverse correlation in their value, i.e., when Bitcoin rises then Altcoins are dropping in their Bitcoin value, and vice versa. However, since 2018 the correlation is unclear.

Regardless, when Bitcoin is volatile, the trading conditions are kind of foggy. During fog, we can’t see much ahead, so it is better to have close targets and stop-losses set or not to trade at all.

Must-Have Tips For Trading Altcoins

Tips for trading Altcoins: Most Altcoins lose their value over time. They usually bleed their value away slowly, sometimes rapidly, but the fact that the largest 20 altcoins by market-cap have changed so much over the past years – tells us a lot.

Take this into account when holding large chunks of altcoins for the medium and the longer term, and of course, choose them carefully and wisely.

If you are considering holding altcoins for the longer term or building a long-term crypto portfolio, keep in mind that the projects or altcoins that have a higher daily trading volume and getting support by a large community, are probably here to stay.

You should follow the coin’s chart and identify low and stable periods. Such periods are likely to be a consolidation or accumulation periods by the whales, and when the right time comes, accompanied by positive project announcements, the pump will start, and the whales will sell in profit.

ICOs, IEOs or Token-Sales

A word about public ICOs or the brand-new 2019 term IEOs: Those are crypto token sales. Many new projects choose to make a crowd-sale where they offer investors an early opportunity to buy a share of the project’s tokens in what is meant to be a reasonable price for the tokens.

The motivation for the investors is that the token will get listed on the secondary market, which is the crypto exchanges, and would yield a nice profit to the early investors. In recent years, there have been many successful token sales: ROI of 10x was something seen very often.

One example was Augur’s ICO, which yielded investors a phenomenal 15x return on investment. Okay, but what’s the catch here? Not all the projects reward their investors. Many sales proved to be complete scams, not only were they not being traded at all but some projects disappeared with the money, and no one heard from them since then.

So how do you know if you should invest in a token-sale? We had recently written about it, we will just mention the amount the project aims to raise: A project which had raised too little will probably will not be able to develop a working product, while a project which had raised huge amount – there won’t be enough investors left out there to buy the tokens on the secondary markets. And most importantly is risk management. Never put all eggs in one basket and invest too much of your portfolio in one IEO or ICO. Those are considered high risk.

Start From Today, Right Now

The following are some practical steps to implement right away:

- Fees, fees, fees: Multiple trade actions equal more fees. It’s always advisable and cheaper to post a new order to the order book, as the maker, and not to buy from the order book (taker).

- Trade with no pressure: Don’t start trading unless you have the optimal conditions to make the right decisions to start a trade and always know when and how to get out of it (trading plan). Pressure always hurts your trading skills. Never rush, wait for the next opportunity, you will get there.

- Setting goals and placing sell orders: always set your goals by placing sell orders. You don’t know when a whale will pump up your coin up to clean up the supply on the order book (and pay a reduced fee on the “maker” side, remember?).

- A successful strategy regarding this is placing low buy orders. The above is taken from Poloniex exchange, December 2016: a crazy flash crash took place, selling off Augor coin down by 75%. After a short while, the market recovered completely. Anyone who had low buy these low orders could easily double or triple his or her investment. Placing low buy orders requires special care, don’t wake up when you’re far away from the market to find that your buy order had executed and now the price is even lower.

- Buy the rumor, sell the news. When major news outlets publish news, it is usually the right time actually to say goodbye to the coin involved.

- You have made a profitable trade, but as always, the moment you sold, the coin runs up again. First, meet this guy – Murphy’s Law. Second, read over what was written previously here and never enter position under pressure or chase the FOMO. As long as there is profit – you are ok. Go on to your next trade and don’t find yourself losing it.

- Leave your ego aside. The goal here is not to be right on your trades, but to gain profit. Do not waste resources (time and money) trying to prove you should’ve been entering that position. Remember, no trader never loses, at least sometimes. The equation is simple – winning trades should be higher than losing trades.

- Bear market conditions are sometimes the best times to make profits: If you hadn’t heard about it, learn how you can short Bitcoin and other cryptocurrencies.

Update 2019

Enjoyed reading? we will appreciate your share! We’ve also published a newer trading tips and common mistakes guide, you can read it here.

Do you have other trading tips? Feel free to mention them as a comment below.

Click here to start trading on BitMEX exchange and receive 10% discount on fees for 6 months.

Be the first to know about our price analysis, crypto news and trading tips: Follow us on Telegram or subscribe to our weekly newsletter.

Copied from:https://cryptopotato.com/8-must-read-tips-trading-bitcoin-altcoins/

No comments:

Post a Comment